Buyer Guide

Buyer Guide

Where Home Meets Heart

We’re Larry Sampson and Chelsea Zupan-Sampson, a husband-and-wife real estate team with Windermere Van Vleet, proudly serving Southern Oregon. Chelsea is a third-generation real estate professional whose family has been in the industry for over 50 years, while Larry brings 15 years of regulatory and compliance experience from his career as a Petroleum Inspector in Trinidad and Tobago. Together, we combine deep local knowledge with detail-driven expertise to deliver exceptional results for our clients.

Our approach is simple: honesty, responsiveness, and care. We believe buying or selling a home should feel empowering, not overwhelming. That’s why we focus on clear communication, quick follow-up, and personalized guidance every step of the way. Whether you’re a first-time buyer, growing a family, or ready for a fresh start, we’re here to help you move forward with confidence.

When we’re not serving clients, you’ll find us enjoying the Southern Oregon lifestyle—hiking trails, photographing wildlife, birding, gardening, or cooking new recipes together. For us, real estate is about more than contracts and closings—it’s about creating a true sense of home.

"My wife and I are first time homebuyers and stumbled across Larry can Chelsea through Zillow. If I could give Larry and Chelsea 10/10 stars I would. From the beginning of the home search to finally closing on a home, all throughout the process they made me and my family feel that we were there only customers at the time. Talking to them after the process, I did find out that they are quite busy, but somehow it never showed when we were with them. The responsiveness was unbelievable. I never felt rushed during the process, we never felt pressured. They provided us with a clear and organized time line once we entered into contract, and made sure we did not miss deadlines. They even went beyond what they need to do to help close the deal. Through the process we never felt alone. For them to make the first time home buying process so smooth is a testament to what kind of quality, and professionalism one can expect from Larry and Chelsea. We recommend them to anyone, and would love to work with them in the future. "

Larry is an incredible realtor who made the process of finding and buying my dream home smooth and stress-free. Larry was always available to answer questions, provide advice, and ensure I felt confident every step of the way. Thanks to his expertise and hard work, I found the perfect house, and I couldn’t be happier with the experience. Highly recommend working with Larry!

We could not have been happier with our Real Estate transaction with Larry & Chelsea Sampson. From the first contact to the final close, our time spent with them searching for the right home was wonderful. We will gladly admit to being a bit of a tough client as our needs were very specific and the market was being stubborn. But, Larry & Chelsea provided us lots of grace and patience, and kept feeding us great options until the right one surfaced. We even had a complex close due to multiple contingencies, but because of their strong ability to organize and communicate, even those complexities were quickly resolved. We are very pleased to recommend Larry & Chelsea for any Real Estate transaction!

Larry is an incredible realtor who made the process of finding and buying my dream home smooth and stress-free. Larry was always available to answer questions, provide advice, and ensure I felt confident every step of the way. Thanks to his expertise and hard work, I found the perfect house, and I couldn’t be happier with the experience. Highly recommend working with Larry!

Larry is an incredible realtor who made the process of finding and buying my dream home smooth and stress-free. Larry was always available to answer questions, provide advice, and ensure I felt confident every step of the way. Thanks to his expertise and hard work, I found the perfect house, and I couldn’t be happier with the experience. Highly recommend working with Larry!

Where Home Meets Heart

We’re Larry Sampson and Chelsea Zupan-Sampson, a husband-and-wife real estate team with Windermere Van Vleet, proudly serving Southern Oregon. Chelsea is a third-generation real estate professional whose family has been in the industry for over 50 years, while Larry brings 15 years of regulatory and compliance experience from his career as a Petroleum Inspector in Trinidad and Tobago. Together, we combine deep local knowledge with detail-driven expertise to deliver exceptional results for our clients.

Our approach is simple: honesty, responsiveness, and care. We believe buying or selling a home should feel empowering, not overwhelming. That’s why we focus on clear communication, quick follow-up, and personalized guidance every step of the way. Whether you’re a first-time buyer, growing a family, or ready for a fresh start, we’re here to help you move forward with confidence.

When we’re not serving clients, you’ll find us enjoying the Southern Oregon lifestyle—hiking trails, photographing wildlife, birding, gardening, or cooking new recipes together. For us, real estate is about more than contracts and closings—it’s about creating a true sense of home.

Why Windermere?

Why Windermere?

It's about relationships.

In 1972, John Jacobi set out to change the real estate industry by putting relationships before sales quotas, with an emphasis on service to our clients and our community. Over 50 years, this mission has helped grow Windermere into one of the largest independent real estate companies in the nation, with more than 300 offices and 7,000 agents throughout the Western U.S. and Mexico.

While the real estate industry has changed substantially over the years, our core values of relationships, community, collaboration, and professionalism have remained central to how we do business, and will continue to do so for years to come

Exceptional Service

Unsurpassed Integrity

A strict code of ethics

Locally owned and operated offices

Neighborhood Knowledge

Market Expertise

Premium Tools and Services

Giving back to our communities

Commitment to

Community

Commitment to

Community

Windermere understands the importance of giving back to our community. Enriching the neighborhoods in which we live and work is an integral part of how we do business.

The Windermere Foundation

❱ We donate a portion of our commission from every transaction to benefit the Windermere Foundation.

❱ Since 1989, the Foundation has collected and contributed over $56 million.

❱ Assistance is provided to non-profit agencies dedicated to helping homeless and low-income families in our community.

Windermere Community Service Day

❱ Since 1984, Windermere agents have dedicated an annual day of work to those in need.

❱ These hands-on projects benefit a wide variety of community-based organizations.

❱ Projects have included maintenance at a senior center, construction of a children’s playground and sorting duties at a food bank.

❱ I am pleased to be a part of such an important mission. It’s just the right thing to do.

How I Help You

Buy Your Home

How I Help You

Buy Your home

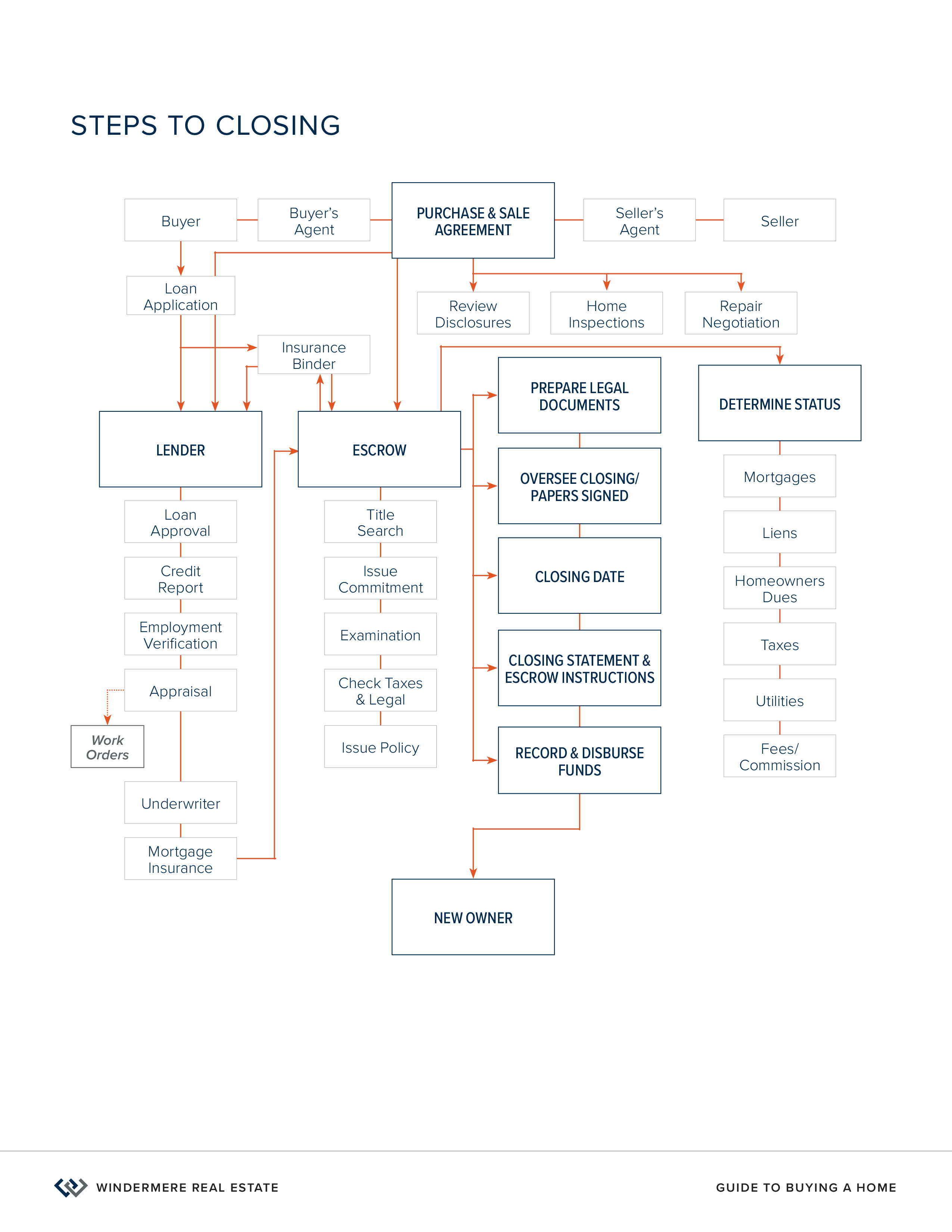

Helping you find and purchase a home is only one facet of my job.

My Serivces

❱ Explain real estate principles, contracts and documents

❱ Refer you to a reputable lender that can help you assess your financial situation and pre-approve you for a loan

❱ Help you determine the types of homes and neighborhoods that most fit your needs

❱ Arrange tours of homes that meet your criteria

❱ Provide you with detailed information about homes you’re interested in

❱ Determine the market value of homes you’re interested in

❱ Assist you in writing and negotiating a mutually-accepted purchase and sale agreement

❱ Accompany you to the inspection

❱ Coordinate necessary steps after inspection

❱ Work with the escrow company to ensure all needed documents are in order and completed in a timely manner

Your Benefits

❱ Be more likely to find the home that meets all your criteria

❱ Decrease the amount of time it takes to find your home

❱ Understand all the terms, processes and paperwork involved

❱ Have current market information to make informed decisions

❱ Have a skilled negotiator on your side

❱ Have peace of mind that the all details are being handled

Answers to

Frequently Asked Questions

Answers to

Frequently Asked Questions

How does my offer get presented to the seller?

In today’s electronic world, offers are sent via email to the seller’s agent. I will call the agent to let them know it’s coming and tell them a little bit about you and the details of your offer. Then I will follow up with the agent again to confirm receipt of your offer.

Does it cost me money to make an offer?

When you write the offer on the home you’ve chosen, you will be expected to include an earnest money deposit. The deposit is a sign of your good faith that you are seriously interested in buying the home.

Where does my earnest money go?

Once the buyer and seller have a mutually accepted offer, the earnest money is deposited into a trust account. That deposit becomes a credit to the buyer and becomes part of the purchase expense.

Is that all the money that’s involved?

Some lenders require the cost of the appraisal and credit report at the time of the loan application.

Can I lose my earnest money?

Real estate contracts are complicated legal transactions. This is another area where having a knowledgeable and professional agent is a necessity. Rarely does the buyer lose the earnest money. Most often, if the transaction falls apart, there are circumstances beyond the buyer’s control that cause it to happen. If the buyer willfully decides, however, that they no longer want to buy the house and has no legal reason for rescinding their offer, then the seller has the right to retain the earnest money.

What happens if I offer less than the asking price?

If you offer less money, the seller has three options. They can accept the lower offer, counter your offer or reject it completely. Remember that there could be another buyer who is also interested in the home you’ve chosen. If they happen to write an offer at the same time you do, the seller will have two offers to compare. There are usually many aspects of each offer to consider, but ultimately the seller will want to accept the best and most complete offer. In active real estate markets, homes often sell for their listed price. In hot markets, there may be many buyers vying for the same house, which sometimes drives the final sale price above the original listing price.

As a real estate professional, I can help you plan your strategy, based on the current real estate market in our area.

What if I need to sell my home before I buy a new one?

To put yourself in the best negotiating position before you find the new home you want, hire a qualified real estate agent to help you put your home on the market. Once you write an offer on a new home, your offer will be “contingent” upon the sale of your home. A buyer in this position may not have the same negotiating power as one whose home has already sold (or at least has an accepted offer). The seller may be hesitant to accept your offer because there are too many things that must happen before the sale can close

Buyer’s Terms

Buyer’s Terms

Loan Amount

The amount of the mortgage based on the purchase price, minus the down payment.

Down Payment

Cash that the buyer provides the lender as their portion of the purchase price. The down payment is considered the buyer’s equity (or cash investment) in their home.

Points

Fees charged by the lender to offset their interest rate, if it’s below the prevailing market rate. One point equals one percentage point—so one point on a $100,000 loan would be $1,000.

Appraisal fee

The amount paid for the lender’s appraisal of the property.

Credit Report Fee

The fee charged by the lender to obtain a credit report on the buyer.

Title Insurance Fee

A one-time premium that a buyer pays for protection against loss or damage in the event of an incorrect search of public records or misinterpretation of title. The title insurance policy also shows what the property is subject to in terms of liens, taxes, encumbrances, deed restrictions and easements.

Escrow Fee

The amount a buyer pays the escrow company or closing agent for preparing papers, accounting for all funds and coordinating the information between all parties involved in the transaction.

Closing Costs

A general term for all the estimated charges associated with the transfer of ownership of the property

Prepaid Interest

The amount of interest due on the loan during the time period between closing of escrow and the first mortgage payment, due at the time of closing.

PITI

The estimated house payment, including principal, interest, taxes and insurance

Principal and Interest

The loan payment, consisting of the amount to be applied against the balance of the loan, and the interest payment, which is charged for interest on the loan.

Total Cash Required

The total amount of cash the buyer will need, including down payment and closing costs

Premium Mortgage Insurance (PMI)

Insurance for the lender, to cover potential losses if the borrower defaults on the loan.

A Commitment to

Fair Housing

A Commitment to

Fair Housing

All of us at Windermere Real Estate are committed to the principles of Fair Housing practices for all. Fair Housing is a matter of treating all people equally while adhering to federal, state, and local laws.

FAIR HOUSING ISSUES

Many buyers and sellers ask questions about the people who live in a neighborhood. Such questions are outside the scope of our professional practice. Some of them raise Fair Housing issues, and all of them seek subjective judgments rather than objective information.

THE LAW

Federal law prohibits discrimination in a real estate transaction based on race, color, religion, familial status, sex, handicap, and/or national origin, and state laws may prohibit discrimination on other bases, such as sexual orientation, veteran/military status, ancestry, and others.

Buyers: Once the buyer and seller have a mutually accepted offer, the earnest money is deposited into a trust account. That deposit becomes a credit to the buyer and becomes part of the purchase expense.

Sellers: If you receive a bona fide offer on a property, you cannot refuse to sell to or negotiate with the prospective buyer based on the aforementioned prohibited criteria. You may not falsely represent that the home is no longer for sale, nor can you advertise the home with an indication of preference or limitation on what type of people may purchase it.

Agents are prohibited from “steering” prospective buyers to specific neighborhoods based on the aforementioned criteria. A victim of discrimination may pursue a civil lawsuit or an administrative claim and seek a temporary restraining order, permanent injunction, actual damages, punitive damages, and attorney’s fees.

FURTHER RESOURCES

For more information, explore your local librariesʼ resources on census figures in your neighborhood(s) of interest. Local police precinct stations and school districts can also provide statistical information to aid your research. Otherwise, much information is available on the Internet to help you determine which neighborhood best suits your needs.